Super @ccount - The first account with bonuses instead of a monthly fee

Salary account that awards you every month

Now you have the freedom to manage your salary account fees – use it regularly for your daily payments and transactions and receive bonuses.

1. What is Super @ccount

?

Super Account is an unusual current account* where you receive your salary and which you can use to make your daily electronic transactions:

- Withdraw cash from ATMs with a debit card;

- Pay at retailers WITHOUT FEES (with a debit card on POS terminal in Bulgaria);

- Shop conveniently online with a debit card;

- Make money transfers and pay utility bills via the internet banking e-Postbank or the mobile banking m-Postbank of the Bank.

2. Why is Super Account unusual ?

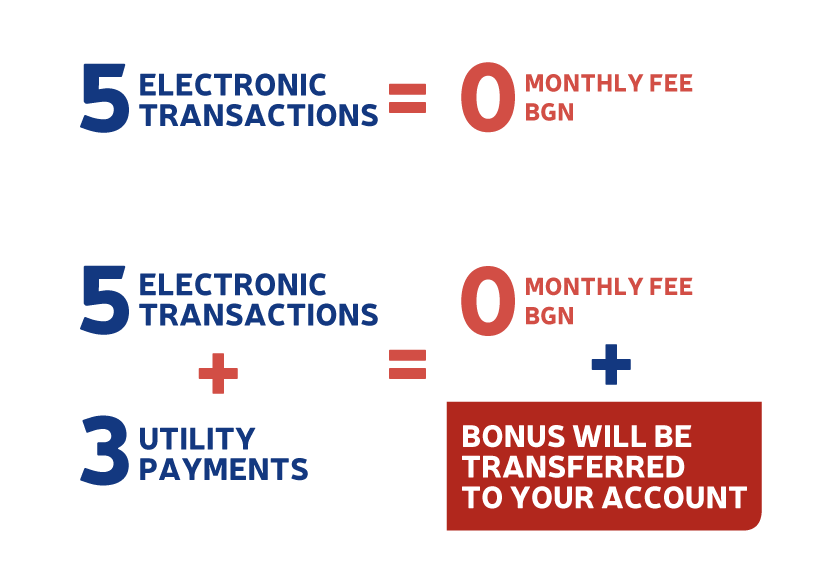

- Removes the annoying monthly fee – make only five debit transactions for the calendar month (by your debit card and/or online payments) and the maintenance fee will be automatically waived for the respective month**;

-

Receive a bonus equal to the monthly fee

– in addition to the five electronic transactions, pay three utility bills in the same month through the internet banking e-Postbank, the mobile banking m-Postbank or u-Postbank (Universal Payer) and receive an additional bonus.***

Example:

* The opening and use of Super Account requires a salary transfer to the account of at least BGN 500 net amount per month and the issuance of a debit card to the account.

** The Bank provides 100% discount from the Super Account’s monthly maintenance fee in line with the Bank's Tariff, if the condition in note 1 has been met within the previous calendar month, and the customer has made at least five transactions from the account through a debit card (payment at a retailer or cash withdrawal from an ATM); through transactions and payments made via Internet Banking e-Postbank/Mobile Banking m-Postbank, or by paying utility bills through the Universal Payer u-Postbank service. Only those transactions for which the account has been debited and have been accounted within the previous calendar month are registered, and all transactions made but unaccounted in the previous calendar month are registered in the month in which they are accounted. Intrabank transactions from the account to other accounts of the customer in the Bank are not taken into consideration; as well as payment of debts on the credit card, issued by the Bank, using the Internet Banking E-Postbank; as well as checking the account balance with the debit card on an ATM. The discount is provided until 30 April 2025. After that date, the Bank has the right to change the size of the discount or to cancel it.

*** The bank provides a monthly bonus of BGN 2.50 if the conditions in notes 1 and 2 above have been met within the previous calendar month and another 3 monthly utility payments have been made (payments of utility bills, local taxes and fees). The three utility payments should be made through Super Account via Internet Banking e-Postbank, Mobile Banking m-Postbank or Universal Payer U-Postbank. Only those transactions for which the account has been debited and have been accounted within the previous calendar month are registered, and all transactions made but unaccounted in the previous calendar month are registered in the month in which they are accounted. Utility bill payments made through an ATM will not be taken into consideration. The bonus will be paid in the account in the next calendar month. The bonus is provided until 30 April 2025. After that date the Bank has the right to change the size of the provided bonus or cancel it.

Postbank

Postbank