METHODOLOGY

FOR DETERMINATION OF REFERENCE INTEREST RATE ON LOANS TO BUSINESS CLIENTS

(PRIME BUSINESS CLIENTS)

1. OBJECTIVE

1.1. The present Methodology establishes and regulates the method for determination of reference rate PRIME Business clients of Eurobank Bulgaria AD (the Bank), as well as the manner of functioning and subsequent changes in the PRIME Business clients.

2. PRIME BUSINESS CLIENTS – SCOPE AND DEFINITION

2.1. PRIME Business clients is the reference interest rate on business clients’ loan agreements with Business clients, for which the Bank has agreed with clients to apply PRIME Business clients.

2.2. PRIME Business clients is a variable rate – it is applied on variable rate loans.

2.3. PRIME Business clients’ rates are differentiated by applicable currencies (BGN and EUR).

3. METHODOLOGY FOR DETERMINATION OF PRIME BUSINESS CLIENTS

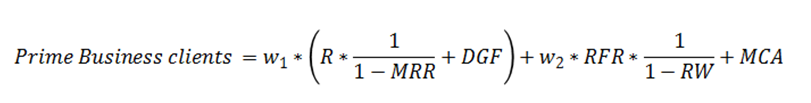

3.1. PRIME Business clients is determined based on the following formula:

whereas:

W1 - weight of household deposits;

W2- weight of capital;

R - interest rate on household deposits;

MRR - minimum reserve requirement in %;

DGF - fixed component 0.5%, related with the expenses for Deposit Guarantee fund and the Banks Restructuring fund;

RFR - risk-free interest rate applicable for Bulgaria;

RW - risk weight;

MCA - adjustment for change in the marginal cost of funds.

4. PRIME BUSINESS CLIENTS COMPONENTS:

4.1 The Weight:

- of Household deposits (w1) is the target ratio in percentage terms of household deposits to total attracted funds; the value of w1 is 88% and could not be changed for the period the present Methodology is in force;

- of capital (w2) is the target ratio in percentage terms of capital to total attracted funds, the value of w2 is 12% and could not be changed for the period the present Methodology is in force

- w1 and w2 are determined so that w1+w2=1.

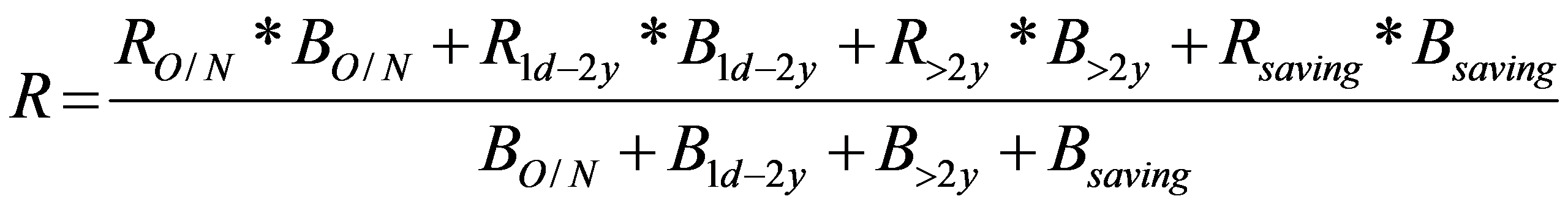

4.2 The Interest rate on household deposits (R):

- is the weighted average interest rate (towards the published volumes) in the respective currency on overnight deposits, time deposits and deposits redeemable at notice of Household sector of the banking system;

- the interest rates are published at the end of each calendar month with data as of the prior reported month on the internet site of Bulgarian National Bank – in section “Interest Rate Statistics of BNB in the report “Interest Rates and Volumes of Outstanding Amounts on Overnight Deposits, Time Deposits and Deposits Redeemable at Notice of Non-financial Corporations and Households Sectors, the applicable data covering Households only (http://www.bnb.bg/Statistics/StMonetaryInterestRate/StInterestRate/StIRInterestRate/index.htm )

- Thе R component in the respective currency is calculated using the following formula:

whereas:

![]() - effective annual interest

rate in the respective currency on overnight deposits of households;

- effective annual interest

rate in the respective currency on overnight deposits of households;

![]() - amount in million BGN of overnight

deposits of households in the respective currency;

- amount in million BGN of overnight

deposits of households in the respective currency;

![]() - effective annual interest rate in the respective currency on time deposits of households with tenor over 1 day up to

2 years;

- effective annual interest rate in the respective currency on time deposits of households with tenor over 1 day up to

2 years;

![]() - amount in million BGN

of time deposits of households in the respective currency with tenor over 1 day up to 2 years;

- amount in million BGN

of time deposits of households in the respective currency with tenor over 1 day up to 2 years;

![]() - effective annual interest rate

in the respective currency on time deposits of households with a tenor over 2 years;

- effective annual interest rate

in the respective currency on time deposits of households with a tenor over 2 years;

![]() - amount in million BGN of time

deposits of households in the respective currency with a tenor over 2 years;

- amount in million BGN of time

deposits of households in the respective currency with a tenor over 2 years;

![]() - effective annual interest rate in the respective currency on deposits of households redeemable at notice;

- effective annual interest rate in the respective currency on deposits of households redeemable at notice;

![]() - amount in million BGN of

deposits of households redeemable at notice in the respective currency;

- amount in million BGN of

deposits of households redeemable at notice in the respective currency;

4.3 The Minimum Reserve Requirement (MRR):

- is 10% which is equal to the legally established percentage, as at the moment of approval of the present Methodology, of reserve assets to total deposit base as per Regulation № 21 for the Minimum Required Reserves Maintained with BNB by the Banks (www.bnb.bg).

4.4 Fixed component 0.5% (DGF):

- Fixed component 0.5%, related with the annual payments that banks shall contribute to the Deposit Guarantee Fund and the Banks’ Restructuring Fund as per the Law on Bank Deposits Guarantee and Law on the Recovery and Resolution of Credit Institutions and Investment Firms, valid at the moment of approval of the present Methodology (www.bnb.bg).

4.5 The Risk-free interest rate applicable for Bulgaria (RFR):

- is the yield to maturity on the secondary market on long-term benchmark government bonds issued by the Republic of Bulgaria, which is used for determination of the long-term interest rate for convergence assessment purposes

- is published on a monthly basis in the Interest Rate Statistics of BNB - in the report Yield on Government Securities and Long-term Interest Rate for Convergence Assessment Purposes

- (http://bnb.bg/Statistics/StMonetaryInterestRate/StInterestRate/StIRInterestRate/index.htm)

4.6 The Risk Weight(RW):

- Is the weighted average risk weight (toward volumes) of the business clients’ loan portfolio according to the accepted collaterals;

- The value of the RW component is set at 65% based on historical experience and the relative stability of the profile of the accepted collaterals of the business clients’ loan portfolio. The value of the RW component cannot be amended during the term of validity of the present Methodology.

4.7 Adjustment for change in the Marginal Cost of Funds (MCA):

- is incremental charge/deduction that reflects the marginal cost of funds;

- At the initial calculation of PRIME Business clients, it is deemed that the value of the MCA component is 0;

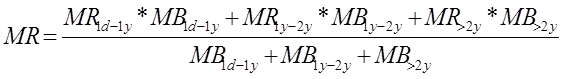

- The MCA component depends on the weighted average interest rate (towards the published volumes) MR in the respective currency on new business time deposits of households published in the Interest Rate Statistics of BNB http://bnb.bg/Statistics/StMonetaryInterestRate/StInterestRate/StIRInterestRate/index.htm)

- The weighted average interest rate MR in the respective currency on new business time deposits of households is calculated using the following formula:

whereas:

![]() - effective annual interest

rate in the respective currency on new business time deposits of households with tenor over 1 day up to 1 year;

- effective annual interest

rate in the respective currency on new business time deposits of households with tenor over 1 day up to 1 year;

![]() - amount in million BGN of new business time deposits of households with tenor over 1 day up to 1 year;

- amount in million BGN of new business time deposits of households with tenor over 1 day up to 1 year;

![]() - effective annual interest rate in the respective currency on new business time deposits of households with tenor over

1 year up to 2 years;

- effective annual interest rate in the respective currency on new business time deposits of households with tenor over

1 year up to 2 years;

![]() - amount in million BGN of

new business time deposits of households in the respective currency with tenor over 1 year up to 2 years;

- amount in million BGN of

new business time deposits of households in the respective currency with tenor over 1 year up to 2 years;

![]() - effective annual interest rate

in the respective currency on new business time deposits of households with tenor over 2 years;

- effective annual interest rate

in the respective currency on new business time deposits of households with tenor over 2 years;

![]() - amount in million BGN of new business time deposits of households in the respective currency with tenor over

2 years;

- amount in million BGN of new business time deposits of households in the respective currency with tenor over

2 years;

The MCA is deemed 0 till the accumulation of at least 100 basis points deviation of MR as from the adoption of the present Methodology.E.g.: Upon a deviation of MR with 60 basis points, the MCA component shall not be changed.Upon a deviation of MR with 120 basis points, there are grounds for a change in the MCA component and it shall be changed to 120 basis points.

- Subsequent changes in the MCA component shall be made upon deviation of at least 100 basis points of MR as from the date of the latest change in the PRIME Business clients.E.g.: Upon a deviation of MR with 60 basis points (as from the date of the latest change in the PRIME Business clients), the MCA component shall not be changed.Upon a deviation of MR with 120 basis points (as from the date of the latest change in the PRIME Business clients), there are grounds for a change in the MCA component and it shall be changed by 120 basis points.

- The participation of the MCA component is by scale factor of 0.5 – each 100 basis points deviation in the component corresponds to 50 basis points change in the PRIME Business clients.E.g.: If the value of the MCA component changes by 120 basis points, PRIME Business clients shall be changed by 60 basis points, all other things being equal.

5. BODY OF THE BANK RESPONSIBLE FOR DETERMINATION AND ADJUSTMENTS IN THE PRIME BUSINESS CLIENTS

5.1 The Assets and Liabilities Committee (ALCO) is the authority of the Bank responsible for initial determination and subsequent

adjustments in the level of the PRIME Business clients.

5.2 In order to ensure adequacy of the PRIME Business clients, ALCO reviews on a quarterly basis the calculated

value as per the formula defined in art.3 of the Methodology by using the data, reported as of the last month of each calendar

quarter and compares the calculated value with the acting PRIME Business clients levels.

5.3 ALCO adjusts the level of the PRIME Business clients when the deviation of the calculated PRIME Business clients value over the acting PRIME Business clients value is 50 basis points or above.

5.4 Any change shall be rounded up to the second digit after the decimal point so that PRIME Business clients can be

divided to 0.05 without remainder.

E.g.: If the calculated PRIME Business clients value is 1.0478, PRIME Business

clients shall be rounded to 1.05 %.

5.5 Upon change of the PRIME Business clients, the Bank duly notifies the clients in accordance with the provisions of the respective loan agreement.

6. SUPPLEMENTARY PROVISIONS:

6.1 The values defined in the current legislation, which the present Methodology refers to, shall be deemed amended in case of amendment in the respective legislative act.

7. FINAL PROVISIONS

7.1. The Methodology for Determination of Reference Interest Rate (PRIME Business clients) on business clients’ loans is adopted by the ALCO of Eurobank Bulgaria, Minutes №, dated from15.06.2018

|

Currency |

PRIME business clients |

Valid from |

|

Euro |

1.05% |

15.06.2018 |

|

Leva |

1.00% |

15.06.2018 |